Tactical Asset Allocation with Macroeconomic Factors

Part 1 - Theory and Frameworks

Introduction: The Power and Flexibility of Tactical Asset Allocation

Hey there, MacroQuant investors! 👋 Welcome to the first part of our deep dive into tactical asset allocation (TAA). In this article, we're laying the groundwork by exploring the theory and frameworks behind this powerful investment strategy. Don't worry, we'll get our hands dirty with practical implementation in Part 2, but for now, let's build a solid understanding of the concepts.

First things first: asset allocation is a big deal. How big? Well, studies have shown that it can explain anywhere from 40% to 90% of the variation in portfolio returns over time. 🤯 That's right – the way you divide your investments across different asset classes can be more important than picking individual stocks or timing the market.

Now, when we talk about asset allocation, we're actually talking about two different approaches:

Strategic Asset Allocation (SAA): This is your long-term game plan. It's based on your goals, risk tolerance, and long-term market expectations. Think of it as setting your course for a long journey.

Tactical Asset Allocation (TAA): This is where things get exciting. TAA is all about making short-term adjustments to your portfolio based on current market conditions. It's like adjusting your sails as the wind changes.

In today's market, with monetary policies shifting and economic cycles evolving, the flexibility that TAA offers is more valuable than ever. It allows us to respond to changes in the market environment, potentially adding value to our portfolios beyond what our long-term strategy alone might achieve.

But here's the million-dollar question: How do we make these tactical decisions? What guides us in adjusting our portfolios as market conditions change?

This is where our focus on macroeconomic factors – specifically, growth and inflation – comes into play. These two economic heavyweights have been shaping market dynamics since the dawn of modern finance, and they're at the heart of some of the most influential TAA models developed by investment giants like Bridgewater Associates and Merrill Lynch.

In this article, we're going to explore how we can use growth and inflation as guiding principles for tactical asset allocation.

Understanding the Growth-Inflation Matrix

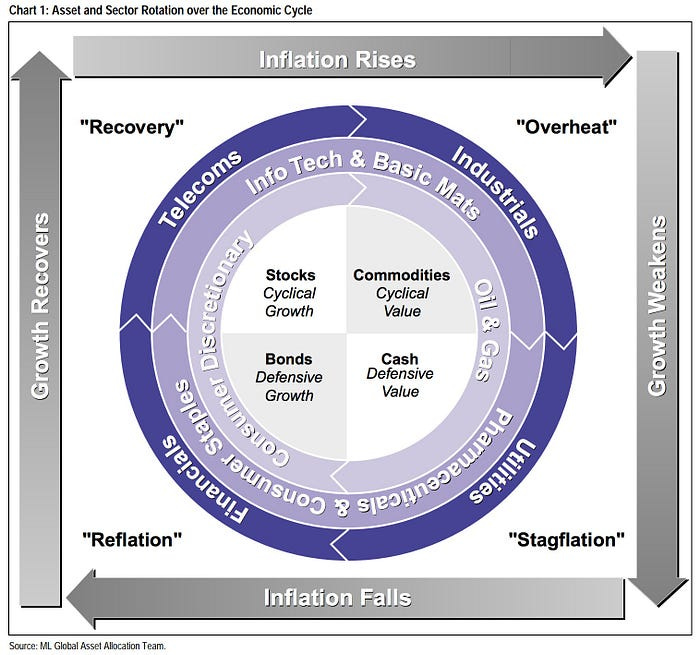

Picture this: a simple grid with growth on one axis and inflation on the other. This, my friends, is the Growth-Inflation Matrix, and it's about to become your new best friend in the world of investing.

This matrix gives us four distinct economic scenarios:

Rising Growth, Falling Inflation: We call this the "Recovery" phase. It's like springtime for the economy.

Rising Growth, Rising Inflation: Welcome to "Overheat". The economy's running hot!

Falling Growth, Rising Inflation: Say hello to everyone's least favorite guest, "Stagflation".

Falling Growth, Falling Inflation: This is "Deflation", and it's as challenging as it sounds.

Now, here's where it gets interesting. Each of these scenarios tends to favor different types of investments:

In Recovery 🌱, stocks often shine, especially those in cyclical and growth sectors.

During Overheat 🔥, commodities and inflation-protected securities typically take the lead.

In Stagflation 😓, cash and inflation-hedged assets often outperform.

In Deflation ❄️, long-duration bonds usually steal the show.

Understanding this matrix isn't just an academic exercise. It's a practical tool that can help you tilt your portfolio towards assets that are likely to perform well in the current or expected economic environment.

The Investment Clock: A Dynamic View of the Economic Cycle

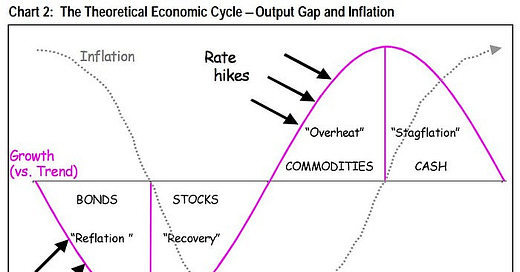

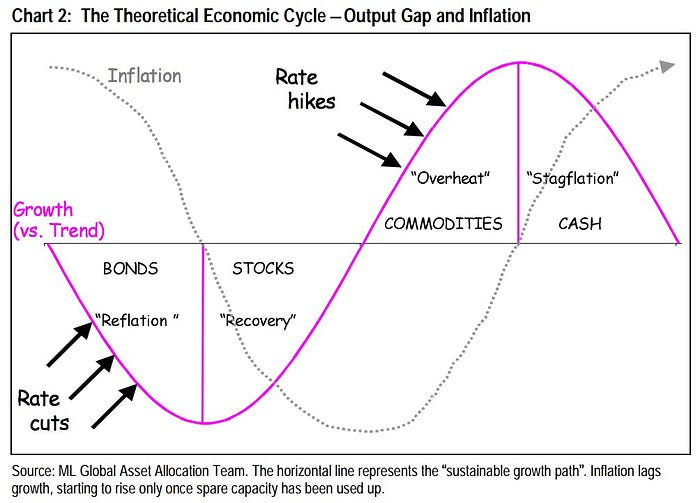

Now, let's look at a model that's tailor-made for tactical thinking: the Investment Clock. This clever tool, popularized Merrill Lynch, visualizes the economy as a clock face. Each position on the clock corresponds to a different phase of the economic cycle.

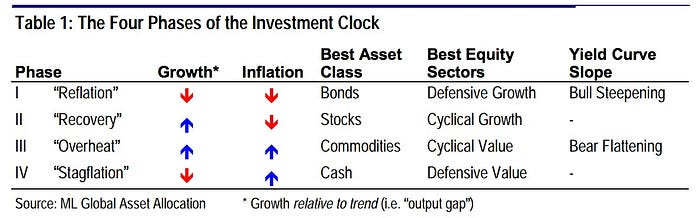

Here's how Merrill Lynch breaks it down:

Recovery: Growth is up, inflation is down. Stocks are the star performers here.

Overheat: Both growth and inflation are rising. Commodities tend to shine in this phase.

Stagflation: Growth is falling, but inflation is rising. Cash often outperforms here.

Deflation: Both growth and inflation are falling. Bonds typically take the lead.

This model offers some key insights:

Cyclicality 🔄: Asset performance tends to follow a predictable pattern that aligns with the economic cycle.

Sector Rotation 🔀: Different sectors of the stock market tend to outperform at different points in the cycle. For instance, defensive sectors might lead during the "Deflation" phase, while cyclical sectors often shine in the "Recovery" phase.

Duration Management ⏳: The model suggests adjusting your portfolio's interest rate sensitivity based on the inflation outlook. When inflation is falling, longer-duration assets (like long-term bonds) tend to perform better.

Tactical Opportunities 🎯: The clock can help you spot potential tactical moves. For example, as the economy shifts from "Recovery" to "Overheat", you might consider reducing your stock exposure and increasing your allocation to commodities.

By understanding where we are in this cycle, we can make more informed decisions about how to tilt our portfolios.

Conclusion: Setting the Stage for Practical Application

So, what have we learned? Tactical asset allocation based on macroeconomic factors it's a powerful tool for navigating market cycles. By understanding the Growth-Inflation Matrix and leveraging the Investment Clock model, we've laid the foundation for building portfolios that are better equipped to handle whatever the economy throws at us.

But let's be real: there's no crystal ball in investing. Economic conditions can be messy and unpredictable, and transitions between regimes aren't always as clean as these models suggest. That's why it's crucial to use these frameworks as guides, not gospel, and always keep a close eye on risk management.

In Part 2 of this series, we'll roll up our sleeves and dive into the practical aspects of implementing these strategies. We'll explore how to assess the current economic environment, translate our analysis into portfolio decisions, and monitor the effectiveness of our tactical moves.

Remember, investing is a journey, not a destination. Stay curious, keep learning, and don't be afraid to adjust your approach as you gain new insights. Happy Investing!

Sources:

Tactical Asset Allocation: The Flexibility Advantage - CFA Institute

The All Weather Story - Bridgewater

How Does Investment Clock Work? - Richard L

The Investment Clock - Merril Lynch

Disclaimer:

The content provided on MacroQuant Insights is for informational and educational purposes only and should not be construed as financial advice. While we strive to provide accurate and timely information, all data and analysis are based on sources believed to be reliable but are not guaranteed for accuracy or completeness. The opinions expressed here are solely those of the author and do not constitute recommendations for any specific investment strategy or security.

Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult with a qualified financial advisor or other professional before making any investment decisions. MacroQuant Insights and its contributors are not responsible for any investment decisions made based on the information provided.

Remember, all investments carry risks, and it is important to fully understand these risks before acting on any information presented on this blog.