The Atlanta Fed's GDPNow is a real-time forecasting tool that estimates GDP growth based on the latest economic data releases. Currently, it's projecting negative growth for Q1 2025, with its standard model showing -1.6% as of early March. This negative reading has sparked concerns about whether the US economy is heading toward a recession. However, looking beneath the surface reveals a more complex picture.

Why the economy isn't as bad as GDPNow suggests

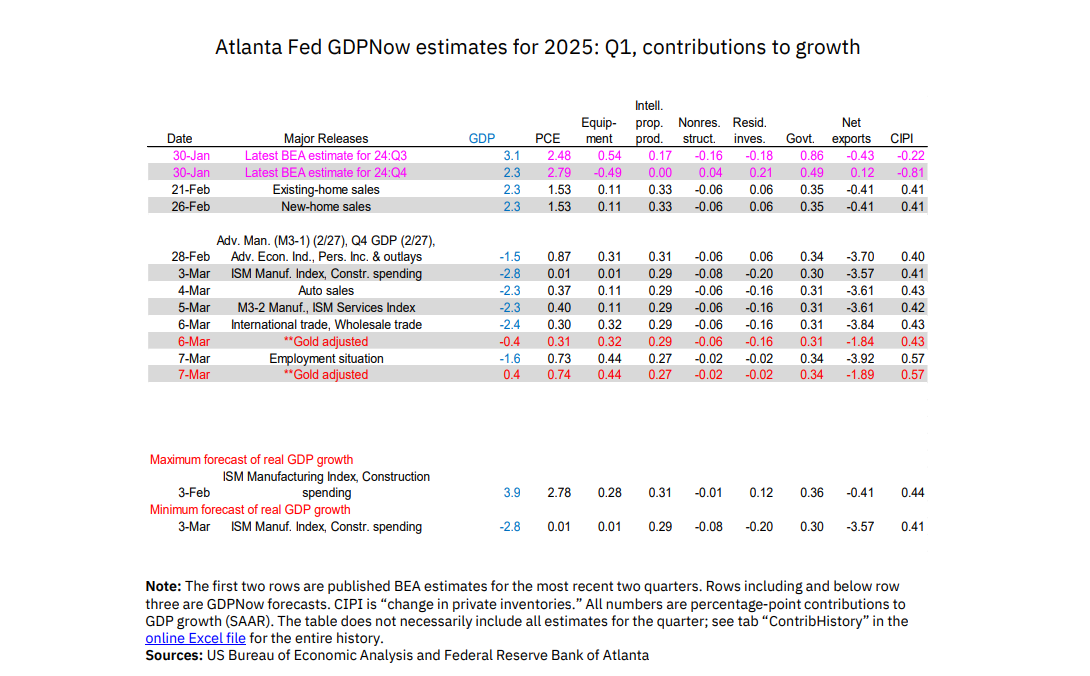

The sharp decline in GDPNow's Q1 2025 forecast was largely driven by January's widening trade deficit—but there's a crucial detail here. Approximately 60% of this deficit expansion came from an extraordinary surge in nonmonetary gold imports, which jumped from $13.2 billion in December to $32.6 billion in January.

This gold import spike appears to be directly related to President Trump's threatened tariffs on Europe. As detailed in recent reporting, gold prices have been driven to record highs, creating a significant price gap between the New York and London markets. Gold is currently worth substantially more in Manhattan than in London, prompting major banks like JPMorgan and HSBC to transport physical gold bars across the Atlantic on commercial flights.

Think of this as a temporary distortion rather than an economic fundamental. While technically these gold imports reduce GDP (since imports subtract from GDP calculation), they don't signal broader economic weakness or reduced consumer spending. Recognizing this anomaly, the Atlanta Fed has begun publishing both standard and "gold-adjusted" forecasts, with the latter showing significantly less negative growth.

When to trust GDPNow vs. economist consensus

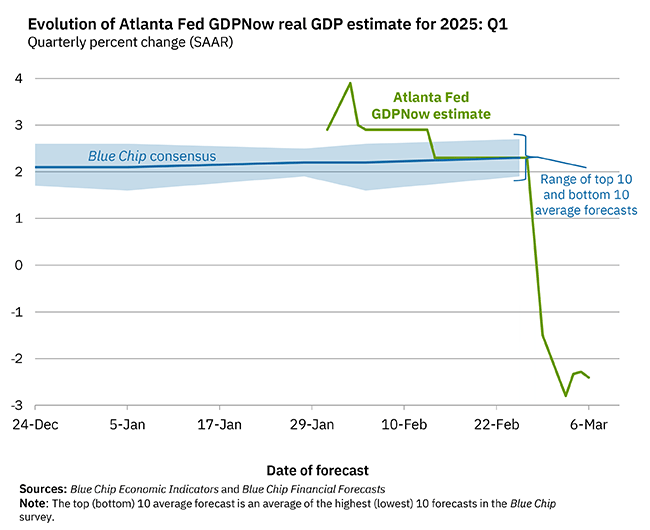

Given that we're still in early March, it's worth noting that we're not yet in the period when GDPNow typically provides its most reliable signals. GDPNow's accuracy follows a predictable pattern that affects when you should pay attention to it:

Early in the quarter: GDPNow exhibits larger errors and significant volatility. This is like trying to predict the final score of a basketball game in the first quarter—theoretically possible but highly unreliable. During this period, consensus forecasts from economists often provide more balanced projections.

When the quarter ends, about a month before the GDP release: This is where GDPNow really shines. Research shows that GDPNow often outperforms consensus forecasts during this period. Since the BEA publishes its first GDP estimate about four weeks after the quarter ends, GDPNow becomes most accurate around the end of the measured quarter, giving us valuable insights before the official numbers are released.

Bottom Line

So, is the US heading into a recession? The headline GDPNow number suggests caution, but the details tell a different story. The negative forecast is substantially driven by a specific, temporary phenomenon in gold imports rather than broad-based economic deterioration.

Looking at the numbers more carefully, removing gold from imports and exports leads to an increase in GDPNow's topline growth forecast from -1.6 percent to a positive 0.4 percent growth. While 0.4 percent isn't particularly robust, timing matters tremendously. We're still relatively early in Q1 2025, so the current reading should be viewed as preliminary. As we move closer to April's GDP release date, GDPNow's accuracy will likely improve, giving us a clearer picture of the economy's direction.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.