The S&P 500 advanced 4.39% this week as U.S. equities rallied strongly despite April's composite PMI falling to a 16-month low of 51.2. This recovery, fueled by reports of easing trade tensions with China and better-than-expected corporate earnings with 73% of companies beating estimates. While manufacturing activity unexpectedly expanded to 50.7, the sharp slowdown in services activity and fastest price increases in over a year highlight the complex impact of tariffs on the economic landscape, even as markets respond positively to potential diplomatic breakthroughs.

⏱️ Global Markets in 10 Seconds:

🇺🇸 S&P 500 +4.39% despite 16-month PMI low 📈

🇪🇺 Services PMI drops to 49.7 first contraction in 5 months 📉

🇬🇧 Retail sales +0.4% defying forecasts as manufacturing sinks 🛍️

🇰🇷 GDP -0.2% q/q surprise contraction amid trade tensions ⚠️

🇮🇳 Services PMI hits 59.1 fastest expansion since December 🚀

🔍 The Big Picture

This week reveals a striking disconnect between deteriorating economic fundamentals and rising market optimism. Global markets rallied on signs of easing trade tensions despite PMIs weakening across multiple regions, highlighting how political developments can sometimes outweigh economic realities in driving investor sentiment. The contrast between cautious business outlook and enthusiastic market response creates an interesting tension as we move deeper into 2025.

United States: The composite PMI sliding to a 16-month low of 51.2 shows economic momentum clearly fading, yet the S&P 500 jumped 4.39% as investors embraced potential trade de-escalation rather than current conditions. Manufacturing surprisingly improved to 50.7, but the sharp services slowdown suggests tariffs are starting to bite in unexpected ways, with price pressures building faster than anticipated.

International: Europe's services PMI dropping below the crucial 50 mark to 49.7 signals the region's first contraction in five months, with particular weakness in economic powerhouses France (46.8) and Germany (48.8). The UK's unexpected retail sales growth of 0.4% provides a rare bright spot, but with both manufacturing and services now firmly in contraction territory, the region faces mounting pressure as we head toward summer.

Emerging Markets: The contrast between South Korea's surprise GDP contraction of 0.2% and India's robust services PMI of 59.1 perfectly illustrates the divergent paths emerging economies are taking. Export-dependent economies are feeling the immediate pain of trade disruptions, while domestically-driven economies with large internal markets are demonstrating remarkable resilience – a pattern that may define investment opportunities throughout the remainder of 2025.

Source: X - Peter Berezin

💼 Market Indicators

SPY Performance

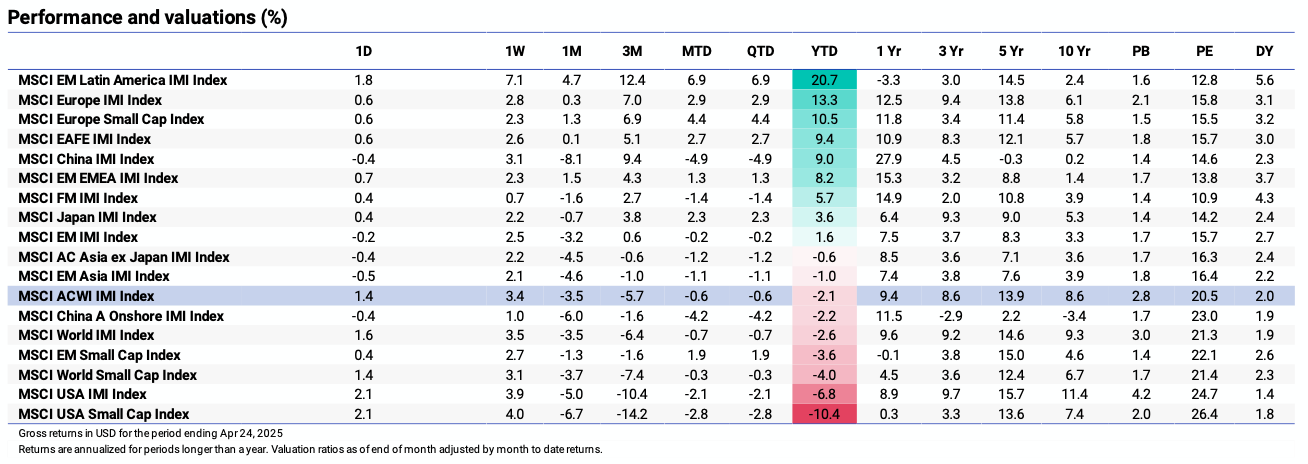

Performance and Valuations by Region

Source: MSCI

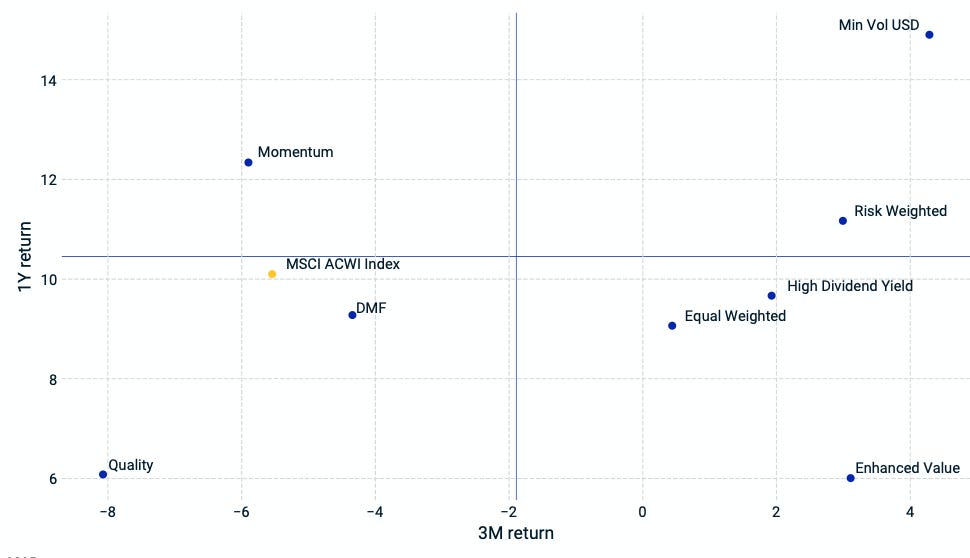

ACWI Momentum performance by Style

Source: MSCI

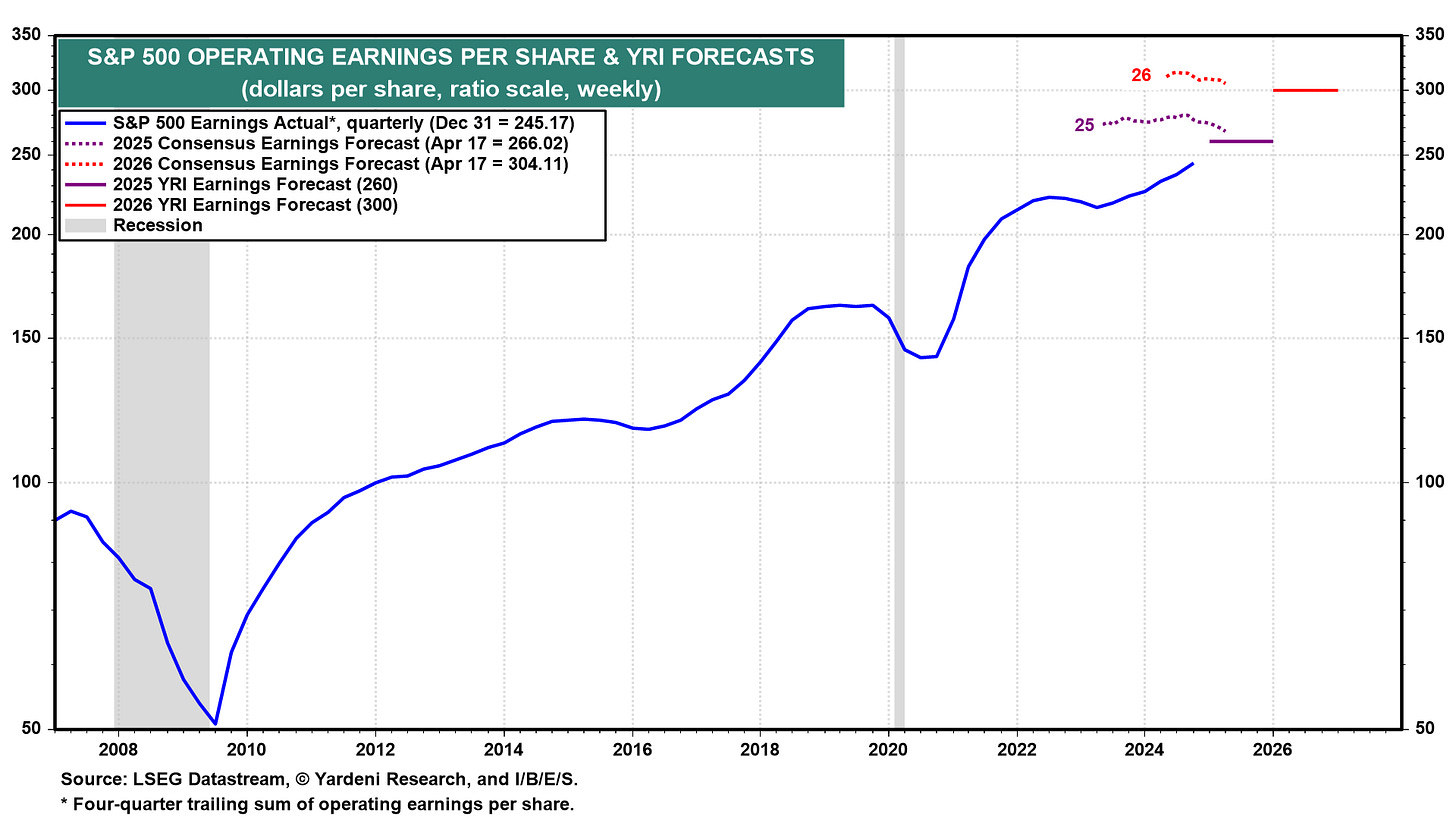

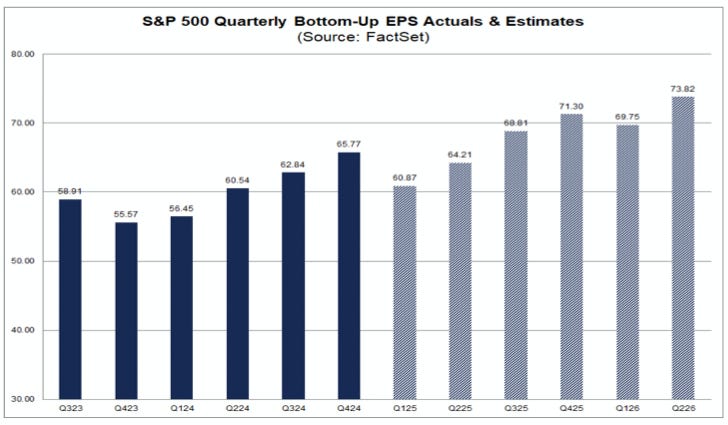

S&P 500 Earnings Per Share

Source: Yardeni Research

Source: FactSet

🗺️ Around the World in Detail

🇺🇸 United States: Unexpected Divergence

Manufacturing PMI surprised at 50.7 in April, climbing above expectations of 49.1 while most analysts were bracing for contraction. The modest expansion marks the fourth consecutive month of growth, suggesting domestic producers might be adapting to the new tariff environment.

Services PMI plummeted to 51.4 from 54.4, falling well below market expectations of 52.5 and marking the second softest growth rate in a year. Client uncertainty due to tariffs and economic policy concerns appears to be hitting the services sector harder than manufacturing.

Consumer sentiment fell for the fourth straight month to 52.2, with expectations down a stunning 32% since January – the steepest three-month decline since the 1990 recession. The 6.5% inflation expectation is the highest since 1981, suggesting consumers are increasingly worried about rising prices.

🌐 International Markets: Recession Shadows

Canada 🇨🇦

Retail sales rose 4.7% year-on-year in February, following a 5.3% increase in January. While slightly slowing, Canadian consumers continue to show resilience compared to their international counterparts.

Europe 🇪🇺

Manufacturing PMI edged up to 48.7 in April, the highest in 27 months but still in contraction territory. The slight improvement comes despite ongoing weakness in new orders and exports, showing the sector remains fragile.

Services PMI dropped below the critical 50 mark to 49.7 in April from 51 in March, marking the first contraction in five months. The weakness was particularly pronounced in France (46.8) and Germany (48.8), suggesting the core of the European economy is struggling.

German growth forecasts were slashed to zero for 2025, with Bundesbank President Nagel even warning of a possible "slight recession" as trade tensions impact the export-dependent economy. After two consecutive years of GDP contraction, Germany appears unable to break free from its economic malaise.

UK 🇬🇧

Manufacturing PMI collapsed to 44 in April, the deepest contraction since August 2023. Export sales were particularly devastated, with the steepest decline outside pandemic times since February 2009, highlighting the market's vulnerability to global trade tensions.

Services PMI fell back into contraction at 48.9 in April after 17 straight months of expansion, catching markets off guard as forecasts expected 51.3. The unexpected reversal suggests the UK's economic foundation might be more fragile than previously thought.

Retail sales surprisingly rose 0.4% in March, defying forecasts of a 0.4% decline. Clothing stores led the way with 3.7% growth, attributed to favorable weather, providing a rare bright spot in an otherwise gloomy economic landscape.

Japan 🇯🇵

Tokyo inflation accelerated to 3.4% in April, the fastest pace in two years and above market expectations of 3.2%. The jump from March's 2.4% strengthens the case for further Bank of Japan rate hikes despite uncertainty about tariff impacts.

Services PMI rebounded to 52.2 in April from a neutral 50.0 in March, with new orders seeing the strongest growth in three months. However, business optimism slipped to its lowest since January 2021 amid concerns over potential U.S. tariff hikes.

Manufacturing PMI remained stuck in contraction at 48.5 in April, marking the tenth consecutive month below 50. New orders declined at the fastest pace since February 2024, while business sentiment weakened to its lowest point since June 2020.l.

🌏 Emerging Markets: Dramatic Contrasts

China 🇨🇳

The Politburo announced preparations for "emergency plans" in response to external shocks, promising new monetary tools and policy financing instruments to boost technology, consumption, and trade. The measured response suggests Beijing is taking a patient approach to countering U.S. tariff impacts.

The PBoC maintained key lending rates for the sixth consecutive month, holding the one-year loan prime rate at 3.1% and the five-year rate at 3.6%. Policymakers appear to be waiting to assess the evolving impact of U.S. trade disputes before introducing further stimulus.

India 🇮🇳

Services PMI jumped to 59.1 in April from 58.5 in March, marking the 45th consecutive month of growth and the fastest expansion since December. New export orders picked up sharply, likely benefiting from the 90-day pause in tariff implementation.

Manufacturing PMI rose to 58.4 in April from 58.1, indicating the fastest pace of growth in a year. New export orders saw their most pronounced increase in over fifteen years, highlighting India's growing strength as a manufacturing alternative to China.

South Korea 🇰🇷

GDP contracted by 0.2% quarter-on-quarter in Q1 2025, shocking analysts who had expected 0.1% growth. Private consumption dipped 0.1%, government consumption fell 0.1%, construction investment plunged 3.2%, and exports dropped 1.1% – a broad-based deterioration suggesting significant vulnerability to global trade disruptions.

Annual GDP growth slowed to just 0.1% year-on-year in Q1, a dramatic deceleration from previous quarters. The near-stagnation highlights how quickly external shocks can impact export-dependent economies, even those with relatively strong fundamentals.

Taiwan 🇹🇼

Unemployment edged higher to 3.36% in March from 3.35% in February, with youth unemployment ticking up to 11.35%, the highest in six months. The modest deterioration suggests labor markets remain relatively stable despite external pressures.

Retail sales rose 0.4% year-on-year in March, recovering from a 3.8% drop in February and surging 10.5% month-on-month. The bounce-back was led by general merchandise (+4.3%) and food and beverages (+4%), demonstrating the resilience of domestic consumption.

🔑 Key Takeaway

This week's data reveals a striking paradox between worsening economic fundamentals and bullish market sentiment, highlighting how trade policy expectations are outweighing actual economic performance.

The U.S. composite PMI's drop to a 16-month low (51.2) didn't prevent the S&P 500 from surging 4.39% as investors focused on possible trade de-escalation rather than deteriorating business conditions. We're witnessing remarkable regional divergence – Eurozone services contracting, UK manufacturing collapsing despite retail resilience, and South Korea's GDP surprisingly contracting while India posts exceptional PMI strength.

The market rally aligns with reports of potential U.S.-China trade tension easing, yet economic data shows concerning trends – multi-year lows in business sentiment, accelerating price increases attributed to tariffs, and consumer inflation expectations surging to 6.5%, their highest since 1981. These contradictions suggest markets are prioritizing hope over economic reality.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.