17% Nvidia Plunge Shakes Tech as AI Rival Emerges

Week Ending January 31, 2025

Nvidia shares tumbled 17% on Monday, dragging the Nasdaq 1.64% lower as China’s DeepSeek unveiled an AI model that threatens to disrupt the industry. This steep sell-off, driven by concerns over lower energy and processing costs of DeepSeek’s model, wiped billions off semiconductor stocks before a late-week rebound, buoyed by strong earnings from Meta and Apple. As tech volatility surged, the Federal Reserve’s steady rate stance and rising tariff risks under Trump added another layer of uncertainty, setting the stage for shifting market narratives in the weeks ahead.

⏱️ Global Markets in 10 Seconds:

🇺🇸 Nvidia -17% as AI rival DeepSeek shakes tech 📉

🇪🇺 ECB cuts rates to 2.75% but growth stalls 🏦

🇨🇳 Manufacturing PMI 49.1 slips back into contraction ⚠️

🇯🇵 BoJ signals more hikes as inflation remains sticky 💰

🇨🇦 BoC cuts rates to 3.00%, ends QT to boost liquidity 🚀

🔍 The Big Picture

Markets navigated a volatile week, with tech stocks reeling from AI competition, central banks adjusting their rate paths, and economic growth showing signs of divergence across regions. Nvidia’s 17% plunge rattled sentiment, while the ECB cut rates, marking a shift in global monetary policy. Meanwhile, China’s manufacturing slowdown added to concerns about its post-pandemic recovery.

United States: 2.3% GDP growth signals a slowdown, but strong consumer spending (4.2%) kept the economy afloat. Meanwhile, the Fed held rates steady, reinforcing its cautious stance on inflation, while tariff threats from Trump added fresh uncertainty.

International: The ECB’s rate cut to 2.75% underscores its confidence that inflation is easing, but Eurozone GDP stalled at 0% in Q4 as Germany and France contracted. Weak growth raises doubts about how much further the ECB can ease policy.

Emerging Markets: China’s PMI dropped to 49.1, slipping back into contraction, while industrial profits fell 3.3% for the third straight year. This contrasts sharply with India, where economic momentum remains strong, highlighting a widening gap in Asia’s growth outlook.

⭐️ Research of the week:

The Shocking Truth About GDP Growth and Returns

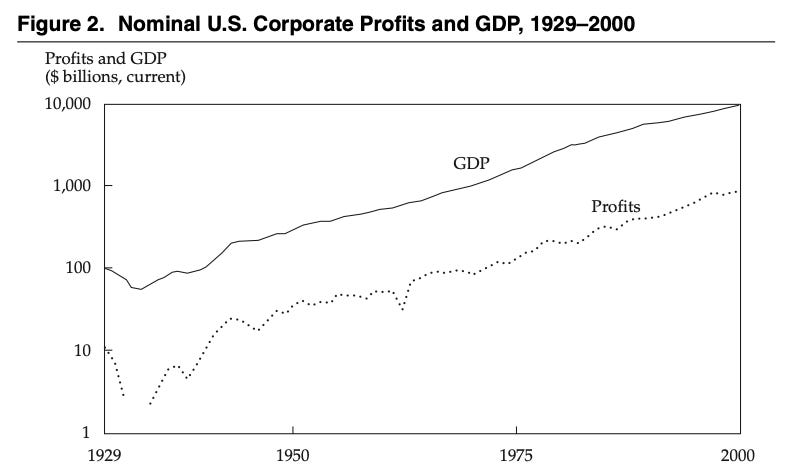

Think fast-growing economies deliver better stock returns? Think again. In their paradigm-shattering 2003 paper, William Bernstein and Robert Arnott exposed an uncomfortable truth: even in booming economies, shareholders consistently lose about 2% of economic growth to dilution. Their research, "Earnings Growth: The Two Percent Dilution," dismantled two cherished myths - that corporate earnings could outpace GDP growth, and that stock buybacks would turbocharge per-share returns.

Why This Analysis Matters:

The researchers used two independent analytical methods - comparing 20th century dividend growth across 16 countries against GDP, and measuring the gap between market cap growth versus share price growth in the CRSP database

Both approaches revealed a consistent 2% annual dilution effect where per-share earnings and dividends grew about 2% slower than the broader economy, contrary to common assumptions

The analysis exposed how focusing solely on aggregate corporate profits without accounting for share dilution can lead investors to overestimate sustainable earnings growth rates

Key Evidence :

Data from 1871-2000 showed real stock prices grew at 2.48% annually versus 3.45% for GDP, with nearly half of the stock price growth coming from multiple expansion rather than fundamental growth

Across 16 developed countries in the 20th century, dividend growth lagged GDP growth by an average of 3.3%, with even peaceful nations seeing a 2.3% gap

Despite the popular narrative around buybacks, the ratio of market cap to price index growth revealed net share issuance consistently exceeded buybacks

Bottom Line:

Investors would do well to focus less on headline GDP growth rates and more on actual per-share earnings growth when evaluating investment opportunities. The persistent gap between economic growth and shareholder returns highlights why understanding company-level fundamentals matters more than macroeconomic headlines.

Source: Earnings Growth: The Two Percent Dilution

💼 Market Indicators

SPY Performance

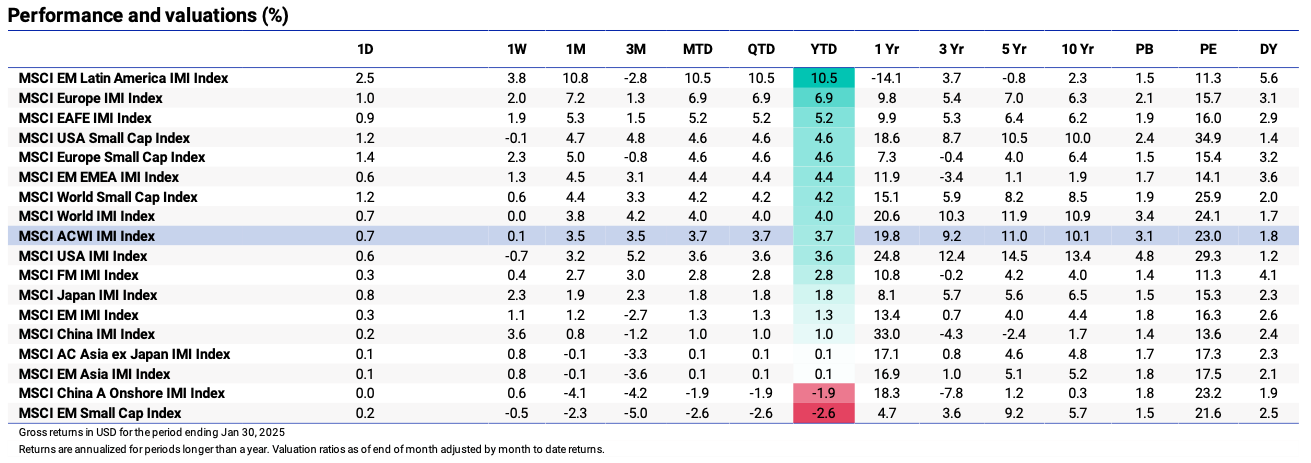

Performance and Valuations by Region

Source: MSCI

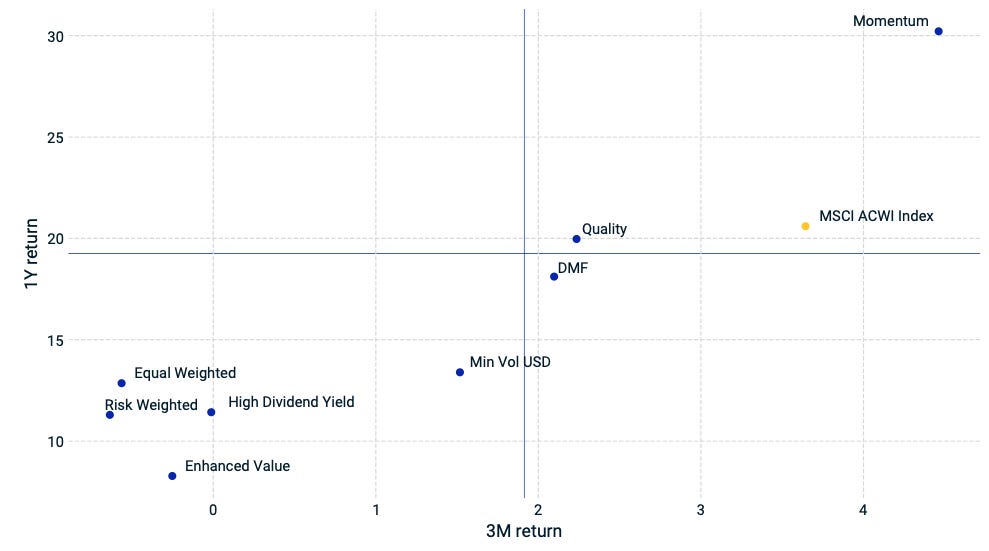

Momentum performance by Style

Source: MSCI

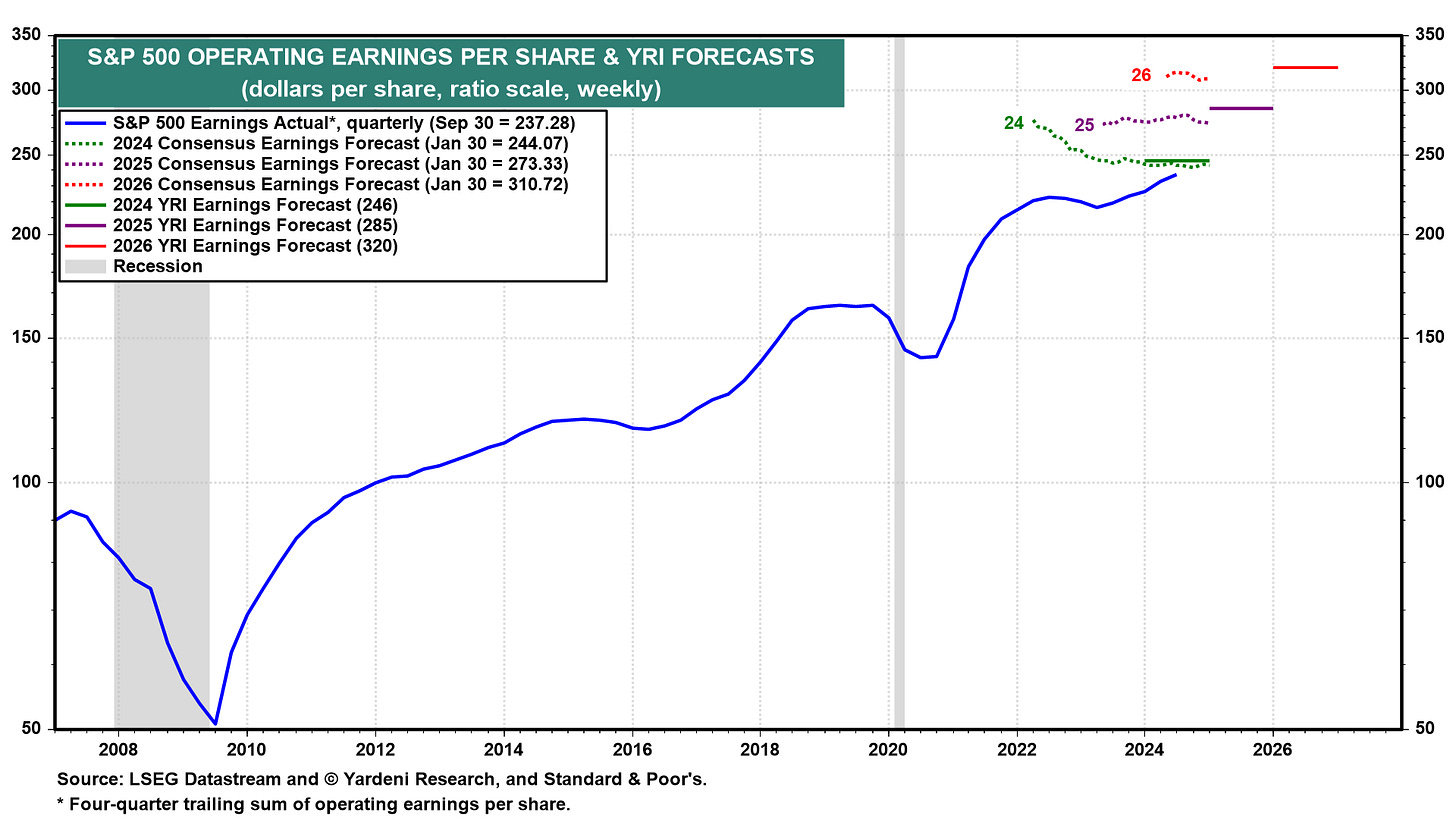

S&P 500 Earnings Per Share

Source: Yardeni Research

🗺️ Around the World in Detail

🇺🇸 United States: AI Shock & Rate Caution

Nvidia drops 17%: The emergence of China’s DeepSeek as an AI competitor sent shockwaves through tech, dragging the Nasdaq down 1.64% and sparking broader concerns over the sector’s dominance.

Fed holds rates at 4.25%-4.50%: Powell reinforced a patient stance, signaling that rate cuts aren’t imminent without more progress on inflation, recalibrating market expectations.

GDP growth slows to 2.3%: Consumer spending surged 4.2%, the strongest in nearly two years, but weaker investment and net exports signal a more uneven expansion heading into 2025.

🌐 International Markets: Central Banks Shift Gears

Canada 🇨🇦

BoC cuts rates to 3.00%: The first major central bank to ease further, the Bank of Canada also ended quantitative tightening, prioritizing liquidity as inflation nears target.

GDP rises 0.2% in December: Growth was supported by retail and manufacturing, but declines in real estate and wholesale trade hint at pockets of weakness.

Europe 🇪🇺

ECB cuts rates to 2.75%: The fifth rate cut since mid-2024 reflects cooling inflation, but with Eurozone GDP flat in Q4, questions remain about the region’s growth outlook.

Germany and France contract: The Eurozone’s two largest economies shrank in Q4, while Spain (+0.8%) and Portugal (+1.5%) saw stronger momentum, highlighting regional divergence.

Japan 🇯🇵

Retail sales jump 3.7%: December’s growth, the strongest in six months, underscores resilient consumer spending despite tighter monetary policy.

Yen strengthens to 154 per USD: Rising expectations of further BoJ rate hikes helped support the currency, though policymakers remain cautious.

🌏 Emerging Markets: Mixed Signals

China 🇨🇳

Manufacturing PMI falls to 49.1: A return to contraction territory signals ongoing weakness in factory activity, as deflationary pressures persist.

Industrial profits drop 3.3%: The third straight year of declines underscores fragile domestic demand, complicating Beijing’s policy response.

South Korea 🇰🇷

Manufacturing PMI slides to 49: A renewed downturn in new orders and rising cost pressures weigh on the sector, reversing earlier improvements.

Retail sales drop 1.9% YoY: The ninth consecutive decline points to weaker consumer confidence, adding to concerns about growth in 2025.

Taiwan 🇹🇼

Manufacturing PMI jumps to 52.7: The strongest reading since July reflects a pickup in export demand, particularly in electronics.

Input costs rise: Firms report higher pricing pressures, with output charge inflation reaching a four-month high, signaling margin compression risks.

🔑 Key Takeaway

This week’s data highlights the growing disconnect between economic resilience and market fragility, as tech-driven volatility, diverging central bank policies, and structural earnings dilution shape the 2025 outlook. Nvidia’s 17% plunge exposed the vulnerability of AI valuations, dragging the Nasdaq down 1.64%, while the Fed’s steady rate stance reinforced a cautious market mood. Meanwhile, the ECB’s rate cut to 2.75% underscored Europe’s stagnant growth, contrasting with Canada’s proactive BoC easing to 3.00% to support liquidity.

In China, the return of manufacturing PMI contraction (49.1) and a third straight year of industrial profit declines (-3.3%) signal deeper structural headwinds, complicating Beijing’s policy response. Japan, however, saw strong retail sales (+3.7%), reinforcing consumer resilience despite tightening monetary conditions. Meanwhile, South Korea’s falling retail sales (-1.9%) and weakening manufacturing PMI (49.0) suggest growing pressure on household spending, reflecting broader divergence in Asia’s economic momentum.

Bernstein & Arnott’s 2% dilution effect is particularly relevant here—investors often expect earnings to track GDP, but dilution from new equity issuance consistently erodes per-share gains. This reinforces the need to focus on productivity and valuation rather than headline growth alone, especially as shifting macro conditions challenge assumptions about long-term equity returns.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.