145% Tariffs Impact China Trade While Markets Rebound

Week Ending April 4, 2025

U.S. stocks rebounded sharply this week, with the Nasdaq Composite climbing 7.29%, following President Trump’s announcement of a 90-day delay on higher tariffs for most trade partners—excluding China, where tariffs rose to 145%. This contributed to heightened market volatility, with the VIX spiking above 40. Treasury yields climbed over 50 basis points, while consumer sentiment dropped to 50.8, reflecting growing recession fears and rising inflation expectations, now at 6.7%.

⏱️ Global Markets in 10 Seconds:

🇺🇸 VIX above 40 for first time since 2020 pandemic crisis ⚠️

🇺🇸 Consumer sentiment 50.8 lowest since June 2022 📉

🇨🇳 Consumer prices -0.1% second month of deflation 🌊

🇬🇧 GDP +0.5% m/m strongest growth in 11 months 🚀

🇯🇵 Yen strengthens to ¥142 as safe-haven flows intensify 💰

🔍 The Big Picture

Trade tensions have become the driving force behind markets, creating a fascinating disconnect between cooling inflation data and surging inflation expectations. This paradox reveals just how much uncertainty is shaping investor psychology, with traditional safe-haven assets behaving in unexpected ways as markets digest what a potential trade war might mean for global growth.

United States: Consumer sentiment crashed to 50.8—the lowest since June 2022—while inflation expectations simultaneously surged to 6.7%, a level we haven't seen since 1981. It's like watching a car with one foot slamming the brake (CPI dropping 0.1% in March) while the other foot floors the accelerator (inflation fears). This split between current reality and future expectations is creating a perfect recipe for market volatility.

Europe: The UK economy surprised everyone with 0.5% monthly growth in February (the strongest in 11 months), completely defying the market's expectation of just 0.1%. This resilience stands in stark contrast to the eurozone, where central banks have shifted to crisis monitoring mode, stepping up their oversight of financial institutions and market liquidity as trade tensions escalate.

Emerging Markets: China's in a peculiar spot—fighting deflation (-0.1% CPI in March) while simultaneously raising tariffs to 125% against the US. It's like trying to revive a fire while simultaneously preparing for a flood. Meanwhile, factory deflation worsened to -2.5%, suggesting Beijing will likely roll out more stimulus measures to counter both deflationary pressures and the growth-dampening effects of escalating trade barriers.

💼 Market Indicators

SPY Performance

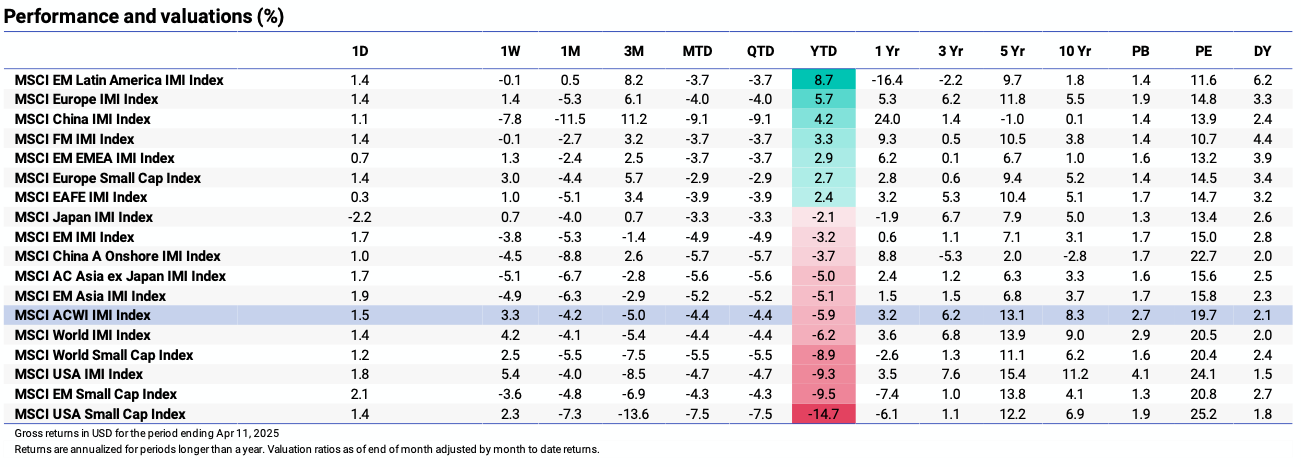

Performance and Valuations by Region

Source: MSCI

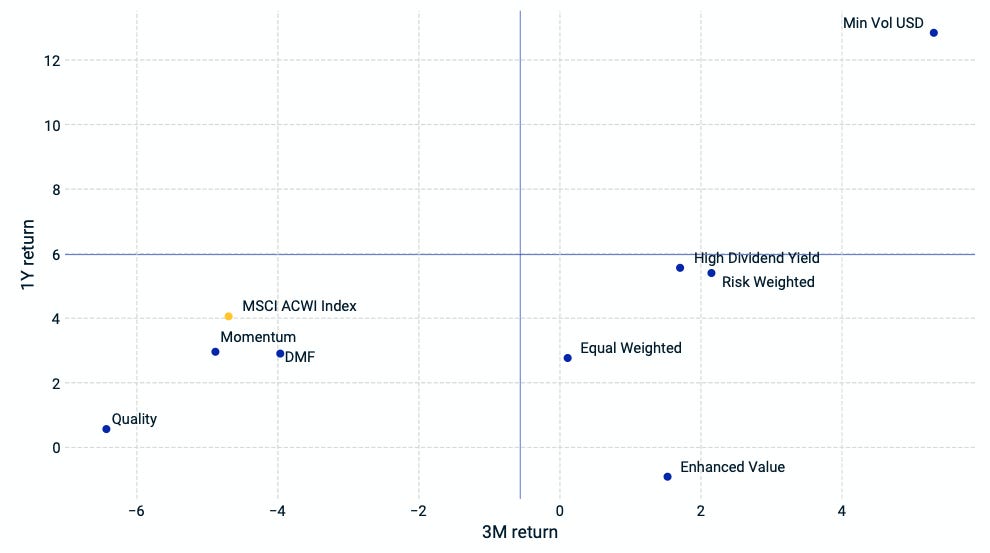

ACWI Momentum performance by Style

Source: MSCI

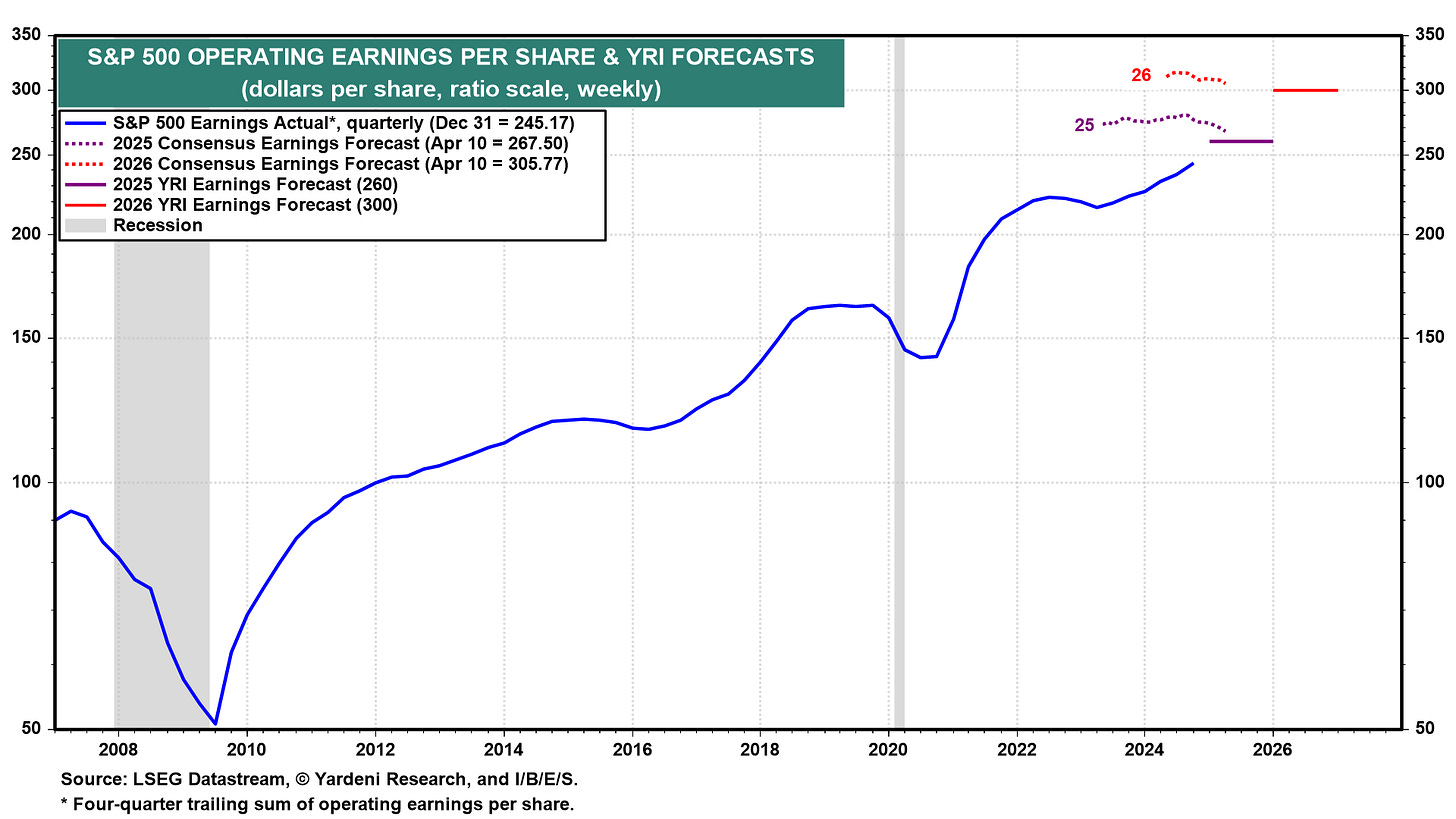

S&P 500 Earnings Per Share

Source: Yardeni Research

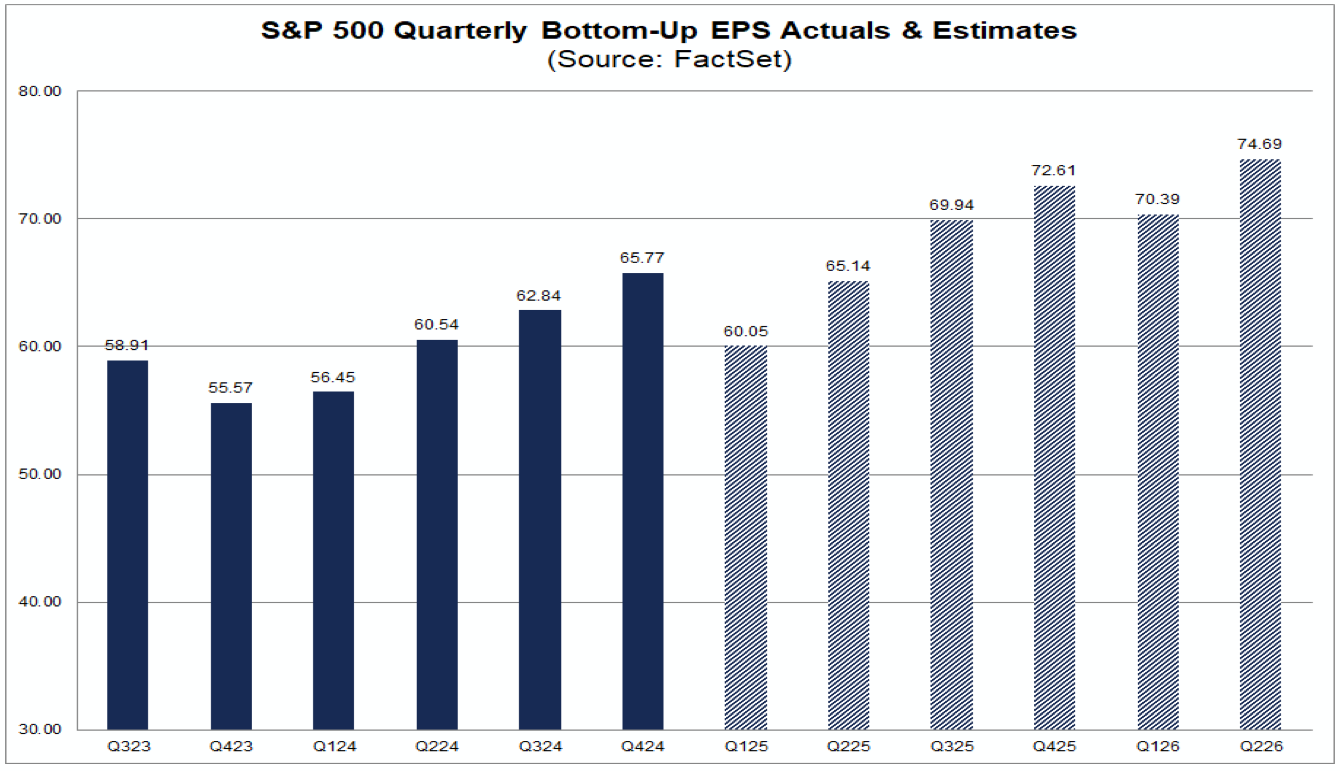

Source: FactSet

🗺️ Around the World in Detail

🇺🇸 United States: Sentiment Crater, Price Relief

Core inflation dropped to 2.8% year-over-year in March, the lowest since March 2021. Think of this as the economy finally getting its temperature down after a three-year fever—right as new trade war symptoms are emerging.

Monthly CPI fell 0.1% in March, marking the first monthly decline since May 2020. This should be a victory lap moment for the Fed, but it's being completely overshadowed by tariff anxiety.

Consumer sentiment plunged to 50.8 in April, sinking for the fourth consecutive month to levels not seen since the darkest days of 2022. When consumers feel this bad historically, they don't just talk about spending less—they actually do it.

The Fed minutes revealed policymakers see "increased downside risks to employment and economic growth" while simultaneously flagging "upside risks to inflation." It's the monetary policy equivalent of being caught between a rock and a hard place—cut rates to support growth, or hold them to fight inflation? The Fed can't do both.

🌐 International Markets: Pockets of Resilience

Canada 🇨🇦

The Ivey PMI settled at 51.3 in March, still in expansion territory despite dropping from February's seven-month high. It's like the Canadian economy is treading water—not swimming forward vigorously, but not drowning either.

Inflationary pressures intensified with the prices index jumping to 75.6 from 71.5, suggesting the Bank of Canada might need to think twice before cutting rates further despite employment numbers turning south (48.2 vs 53.7).

Europe 🇪🇺

Retail sales surprised on the upside, growing 2.3% year-over-year in February and exceeding market expectations of 1.8%. European consumers are still spending despite everything, giving the ECB some breathing room on rate decisions.

Central banks have switched to crisis-monitoring mode, with both the ECB and BoE stepping up surveillance of financial institutions and markets. It's like watching the financial system's vital signs more frequently when the patient shows signs of distress.

UK 🇬🇧

The British economy expanded by a robust 0.5% month-over-month in February, completely blowing past expectations of 0.1%. This is like finding unexpected growth in the garden during what was supposed to be a frosty winter.

Manufacturing output surged 2.2%, with computer and electronics production soaring 9.8%. The UK manufacturing sector is showing remarkable resilience just as global trade tensions threaten to upend supply chains.

Japan 🇯🇵

Consumer confidence fell to 34.1 in March, declining for the fourth straight month to reach its lowest level since March 2023. Japanese consumers are battening down the hatches even before the full impact of global trade tensions hits.

The yen strengthened dramatically to the JPY 142 range against the dollar, emerging as a classic safe-haven play. It's like watching investors grab a financial umbrella as storm clouds gather over global markets.

🌏 Emerging Markets: Divergent Fortunes

China 🇨🇳

Consumer prices fell 0.1% year-over-year in March, marking the second consecutive month of deflation. China's economy is like a patient struggling with low blood pressure while the doctor (policymakers) prepares stronger medicine.

Factory-gate deflation worsened to -2.5%, suggesting China's manufacturing sector continues to struggle with overcapacity. This deflationary pressure couldn't come at a worse time as tariffs with the U.S. escalate to unprecedented levels (China's now at 125%, while U.S. tariffs on China hit 145%).

India 🇮🇳

The Reserve Bank of India cut its key repo rate by 25bps to 6%, the second consecutive cut, bringing rates to their lowest level since November 2022. Think of this as India's central bank giving the economy a gentle push forward while carefully watching for inflation.

RBI revised GDP growth forecasts slightly downward to 6.5% for FY2025/26, while inflation estimates were trimmed to 4% from 4.2%. India's stance is essentially: "We're still growing faster than almost anyone else, but maybe not quite as fast as we thought."

South Korea 🇰🇷

Unemployment ticked up to 2.9% in March from 2.7%, the first increase in three months. This small deterioration is hitting right as South Korea braces for the impact of U.S. tariffs, including a 25% levy on its exports.

Labor force participation climbed to 64.6% despite rising unemployment, suggesting South Koreans are actively seeking work rather than dropping out of the labor market—a potential sign of economic confidence despite headwinds.

Taiwan 🇹🇼

Inflation climbed to 2.29% in March from a near four-year low of 1.58%. Food prices jumped 4.9%, eating into consumer purchasing power just as trade tensions threaten Taiwan's export-heavy economy.

Taiwan Semiconductor Manufacturing Co. saw quarterly revenue surge 42%, as electronics manufacturers rushed to stockpile goods ahead of tariff implementation. It's like watching people fill their shopping carts before a price increase hits the shelves.

🔑 Key Takeaway

This week's data reveals the profound psychological impact of trade tensions, creating a market paradox where actual inflation is cooling while inflation fears are skyrocketing to 1980s levels. The explosive disconnect between sentiment (plunging to 50.8) and forward inflation expectations (surging to 6.7%) demonstrates how uncertainty reframes economic data, transforming what should be good news into warning signals.

Supply chains have already begun adapting to the new reality, with semiconductor stocks up 4.33% and hardware companies scrambling to deliver products before tariffs hit—pushing PC shipments to their fastest growth since the pandemic. Meanwhile, traditional market relationships are breaking down as Treasury yields spike alongside safe-haven currencies like the yen, suggesting investors are fundamentally reassessing risk in a potential trade war environment where even defensive assets need a second look.

The content provided on MacroQuant Insights is for informational and educational purposes only and does not constitute financial advice. While every effort is made to ensure accuracy and reliability, all data, analysis, and opinions are based on sources believed to be trustworthy but are not guaranteed for completeness or timeliness. The views expressed are solely those of the author and do not reflect endorsements or recommendations for any specific investment, strategy, or action.

Investing involves inherent risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or professional before making any financial decisions. MacroQuant Insights and its contributors disclaim all liability for investment decisions based on the information provided and make no warranties regarding the content’s accuracy or reliability.

Remember, all investments carry risks, and it is essential to understand these risks fully before acting on any information presented. Users are responsible for their own investment decisions. MacroQuant Insights assumes no responsibility for any outcomes resulting from the use of this information. Content is subject to change without notice.